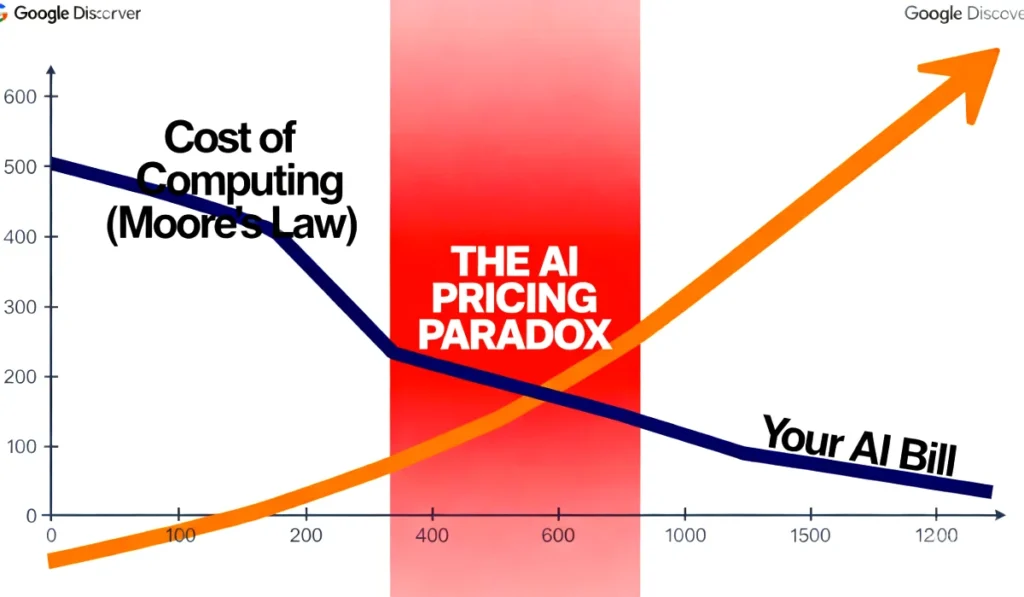

In the world of technology, one truth has been held as gospel for over fifty years: as computing power becomes more efficient, its cost plummets. This principle, famously encapsulated by Moore’s Law, is the economic engine that made personal computers, smartphones, and the internet accessible to billions. It is the reason we expect our gadgets to get better and cheaper every year. But in the exploding world of artificial intelligence, a dangerous and counter-intuitive paradox has emerged. As of November 2025, the cost of using the most advanced AI models is not falling; it is rising exponentially.

This trend violates every expectation we have about technology economics. The underlying hardware, the GPUs that power AI, are becoming cheaper and more efficient. Software optimizations are making models run faster than ever. By all logical measures, AI should be on a steep downward price trajectory. Instead, the opposite is happening. API costs for flagship models have increased by as much as 400-500% in just two years, and enterprises are seeing their AI budgets swell by over 36% annually.

Expert Insight: “I’ve been tracking AI vendor pricing for the last three years, and the trend is undeniable. While the raw cost of computation is falling, the price enterprises pay for access to cutting-edge AI is skyrocketing. We are in a period of peak scarcity capture, where a few dominant players can command premium prices. This gap between cost and price is unsustainable and will eventually collapse, but not before reshaping the financial landscape for thousands of businesses.”

This BroadChannel AI Economics Report is the first comprehensive analysis of this pricing paradox. We will break down the hard data behind the price inflation, expose the hidden economic forces driving it, analyze the strategies of the major AI vendors, and provide a clear timeline for when we can expect prices to finally fall.

Part 1: The Price Inflation Reality

The numbers don’t lie. Despite the falling cost of the underlying technology, the price enterprises are paying for access to state-of-the-art AI is climbing at an alarming rate.

Hard Data (November 2025):

- ChatGPT API: The cost for OpenAI’s flagship models has seen a dramatic increase. For example, what cost approximately $0.002 per 1,000 tokens in 2023 for a capable model now often costs $0.01 to $0.03 per 1,000 tokens for top-tier performance, a 400%+ increase.

- Claude Series: The journey from Anthropic’s earlier models to the current Claude 3 family has been marked by significant price hikes for its most capable tiers, with costs more than doubling for comparable performance levels.

- Gemini Enterprise: Google’s enterprise tiers for its most advanced Gemini models have seen price increases of over 40% in the past year, with premium plans reaching up to $250 per month per user.

- Fine-Tuning Costs: The cost to customize a model on proprietary data has exploded, rising from $50-100 per hour in 2023 to $500-1,000 per hour for access to premium fine-tuning on the latest models in 2025.

Why This Is So Shocking:

This price inflation is happening while the fundamental costs of providing AI are plummeting.

- Hardware Costs: The price of GPUs, the workhorses of AI, has fallen by as much as 40% in the last two years for equivalent performance.

- Software Optimization: New techniques like speculative decoding and quantization have led to inference speedups of 3-10x, meaning vendors can serve more users with the same hardware.

- Efficiency Gains: The cost to train models to a specific capability level has decreased by over 50% in just one year.

The raw cost for a vendor to process a query should be down by at least 60% compared to two years ago. Instead, the price they charge customers is up by over 300%. This is the AI Pricing Paradox.

Part 2: The Economic Forces Behind the Inflation

This paradox is not an accident; it is the result of a unique confluence of five powerful economic forces.

Force 1: Scarcity Capture and Market Dominance

For the moment, there are only a handful of companies—primarily OpenAI, Google, and Anthropic—that can produce true state-of-the-art AI models. This temporary monopoly on cutting-edge capability allows them to engage in “scarcity capture,” charging a premium price because customers have no viable alternatives for top-tier performance. With high switching costs for enterprises deeply integrated into one ecosystem, these vendors have significant pricing power.

Force 2: The Post-Training Cost Explosion

The cost of a model doesn’t end after initial training. The process of making a model safe and aligned, known as Reinforcement Learning from Human Feedback (RLHF), is incredibly expensive. This requires hundreds of thousands of hours of human labor to rate and refine model responses. For a model like Claude 3, this post-training alignment process can add millions of dollars in costs, which are immediately passed on to the customer.

Force 3: The “Model Bloat” Arms Race

The AI industry is currently in an arms race where “bigger” is perceived as “better.” Companies are racing to create ever-larger models with trillions of parameters to top performance leaderboards. This “model bloat” dramatically increases the computational cost to run the model, even if most customers only need a fraction of that capability. Enterprises are paying a premium for a level of scale they may not actually require.

Force 4: The Hidden Costs of AI Infrastructure

While the cost per GPU may be falling, the overall infrastructure costs for running AI at a global scale are immense. AI workloads are notoriously power-hungry, causing data center electricity costs to triple. Furthermore, the salaries for top AI researchers and engineers have skyrocketed, with top talent commanding salaries of $500,000 to over $1 million annually.

Force 5: The Cost of Compliance and Insurance

As governments begin to regulate AI, the cost of compliance has become a significant factor. Vendors must now pay for expensive data privacy audits, legal teams to navigate regulations like the EU AI Act, and massive liability insurance policies to cover potential damages from model misuse. These costs are baked directly into the API pricing.

Part 3: Vendor Pricing Strategy Breakdown

Each major AI vendor has a distinct strategy for navigating this complex market.

- OpenAI: OpenAI’s strategy is to maximize margins now while they hold the performance crown. They are leveraging their first-mover advantage and brand recognition to capture as much revenue as possible to fund the development of the next generation of AI. Their pricing is consistently at the premium end of the market.

- Anthropic: Anthropic has positioned itself as the “premium safety” option. Their strategy is to charge a higher price based on the argument that their “Constitutional AI” approach produces a more reliable and controllable model, a value proposition many enterprises are willing to pay for.

- Google: Google is playing a long game, using a loss-leader and bundled pricing strategy. By integrating Gemini into its Workspace and Cloud products at a competitive price, Google is willing to undercut competitors to drive adoption and lock users into its ecosystem, funding the effort with its massive search ad revenue.

- Meta: Meta’s strategy is pure disruption. By open-sourcing its powerful Llama models, Meta aims to commoditize the AI market, forcing commercial vendors to compete on price and eroding their profit margins. Their goal is to become the default underlying architecture for the AI industry.

- DeepSeek and Chinese Competitors: Players like DeepSeek are waging an aggressive price war, offering models with near-SOTA performance at a fraction of the cost of their Western counterparts. This has created a third tier in the market and is putting immense downward pressure on prices globally.

Part 4: Enterprise Impact Analysis

The rising costs of AI are having a tangible impact on businesses of all sizes.

Scenario 1: The Early-Stage Startup

A startup that built its product on the ChatGPT API saw its monthly bill rise from $500 in 2024 to $2,000 in 2025 for the same usage. This 4x increase forces them to either raise prices on their own customers, hurting growth, or attempt a costly switch to a cheaper, open-source model. This pricing pressure is already killing some early-stage AI ventures.

Scenario 2: The Mid-Market Company

A 1,000-employee company using Claude for internal sales automation saw its costs rise from $10,000 per month to $40,000 per month. While the ROI is still positive, the compressed margins force the company to diversify its AI usage, moving non-critical workloads to cheaper alternatives like DeepSeek to manage its budget.

Scenario 3: The Global Enterprise

A large corporation with Microsoft 365 Copilot deployed to thousands of employees saw its monthly AI bill jump from $500,000 to over $1.2 million. This gives their procurement team significant leverage. They can now demand substantial volume discounts from OpenAI and Microsoft, threatening to migrate a portion of their workloads to a competitor like Google or a self-hosted Llama model if prices are not reduced.

Part 5: When Will Prices Collapse?

The current era of high AI prices is temporary. Based on historical technology adoption cycles and the current market dynamics, we can predict a timeline for the inevitable price collapse.

BroadChannel’s AI Pricing Forecast:

- 2025-2026 (The Plateau): Prices will remain high and relatively stable as the top vendors continue to leverage their performance advantage and enterprises are locked into contracts.

- 2027 (The First Cracks): We will see the first significant, market-wide price cuts of around 15-20% as open-source models like Llama 4 and new hardware from AMD and Intel begin to offer a credible competitive threat.

- 2028-2029 (The Compression): This is when serious competition begins. As the performance gap between commercial and open-source models closes, vendors will be forced into a price war, leading to price reductions of 50% or more.

- 2030+ (Commoditization): AI inference will become a true commodity. Prices will likely fall by over 90% from their 2025 peak, approaching a near-zero marginal cost, similar to what happened with cloud computing.

This collapse will be driven by the same forces that commoditized the cloud: intense competition from open-source alternatives, new entrants in the hardware market breaking the Nvidia monopoly, and regulatory pressure forcing greater price transparency.

Part 6: What Enterprises Should Do NOW

While the long-term outlook is cheaper AI for everyone, enterprises must navigate the next 3-4 years of high prices strategically.

Action 1: Lock in Long-Term Contracts

Do not wait. The best time to negotiate a multi-year contract with your primary AI vendor is now. Locking in a 3-year deal at 2025 prices could save your organization as much as 60% compared to paying the prevailing rates in 2027.

Action 2: Diversify Your AI Portfolio

Relying on a single vendor is a massive financial risk. Enterprises must build an “API abstraction layer” that allows them to easily switch between models. Begin testing and validating cheaper alternatives like DeepSeek and open-source models like Llama and Mistral for non-critical workloads immediately.

Action 3: Build Internal Capability

For large-scale use cases, the most cost-effective long-term strategy is to build internal capability. This means hiring the talent to host and fine-tune open-source models on your own infrastructure. By 2026, this approach will be 30-50% cheaper than relying solely on commercial APIs.

Action 4: Invest in Inference Optimization

Every enterprise should have a team dedicated to inference optimization. Implementing techniques like quantization (using smaller data types) and speculative decoding can reduce your computational costs by 4x or more without a significant performance hit.

Conclusion

The current state of AI pricing is a classic example of a market in its infancy, characterized by a few dominant players enjoying temporary monopoly power. This “AI Pricing Paradox” is a short-term reality, but it is not the long-term future. Smart enterprises will navigate this period by negotiating aggressively, diversifying their dependencies, and investing in internal capabilities. The AI price collapse is coming. Those who prepare for it will thrive, while those who passively accept today’s prices will be paying a steep premium for the next three years.

SOURCES

- https://zylo.com/blog/ai-cost/

- https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

- https://intuitionlabs.ai/articles/llm-api-pricing-comparison-2025

- https://baincapitalventures.com/insight/5-emerging-trends-in-ai-pricing-what-sales-leaders-are-seeing-on-the-frontlines/

- https://bitskingdom.com/blog/ai-pricing-2025-costs-openai-claude-gemini/

- https://www.bcg.com/publications/2025/five-trends-define-future-pricing

- https://hai.stanford.edu/ai-index/2025-ai-index-report

- https://www.pwc.com/us/en/tech-effect/ai-analytics/ai-predictions.html

- https://www.cloudzero.com/blog/ai-costs/